Instytut Emerytalny z dumą prezentuje abstrakty naszych dwóch ekspertów z wystąpień z Konferencji Emerytalnej, która odbyła się na Politechnice Poznańskiej w dniach 28-29 września 2022 roku. Po więcej informacji zapraszamy do śledzenia witryny https://www.put.poznan.pl/artykul/konferencja-emerytalna-na-politechnice-poznanskiej.

Oba teksty Profesora Szczepańskiego oraz Doktora Kolka , których streszczenia znajdą Państwo poniżej są dostępne w języku angielskim w zakładce „Publikacje”

SUBJECTIVE ASSESSMENTS OF LIFE EXPECTANCY AND LONGEVITY RISK MANAGEMENT

prof. Marek Szczepański, Dr Tomasz Brzęczek

Growing life expectancy also increases the risk of longevity (age risk) associated with a longer-than-expected life expectancy. This risk has an individual and a group dimension. On an individual basis, the realization of this risk may mean exhaustion of additional retirement savings and scarcity, and often even poverty, of elderly people who live longer-than-expected. The subjective assessment of life expectancy has a significant impact on household decisions regarding the division of income between current consumption and saving (deferred consumption), and thus – the amount of additional resources accumulated for the old age, and thus – the level of individual longevity risk. This paper aims at comparing the subjective life expectancy estimates with the values provided by the Statistics Poland in the life tables for given age groups (demographic cohorts). Subjective life expectancy estimates for selected age groups of women and men were identified in a nation-wide sample survey.

PUBLIC TRIBUTES IMPOSED ON AGE-RELATED BENEFITS – A COMPARATIVE ANALYSIS

dr Antoni Kolek

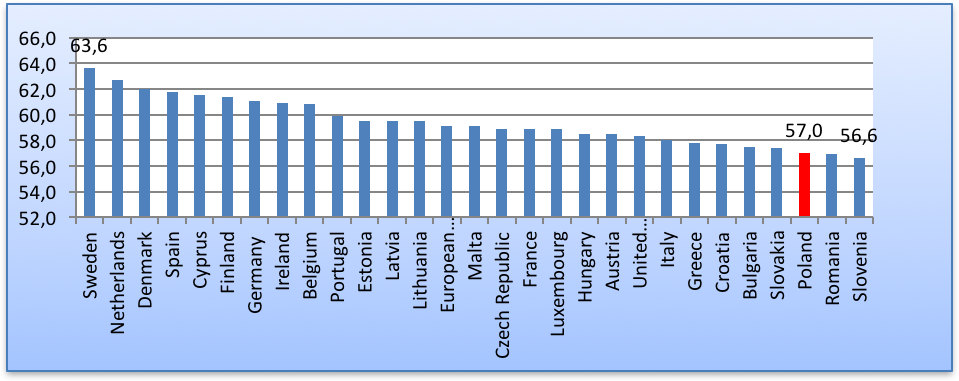

The comparison of pension systems often boils down to comparing the subjective scopes entitled to participate in the system, the number of benefits and their relation to other macroeconomic indicators or parameters of the pension system influencing system efficiency. In the comparative literature, however, less content is concerned with the principles of taxation of and accrual of contributions to age-related benefits. In view of the changes in the tax system that are currently taking place in Poland, this paper dwells upon the characteristics of solutions used in other countries, and also indicates similarities and differences, and specifies models of applying public tributes on age-related benefits.